- 100% FREE TO USE

- WON'T MARK YOUR CREDIT FILE

- NO OBLIGATIONS

- QUICK SMART

Compare business loans at ebroker the #1 non-bank business finance marketplace in Australia.

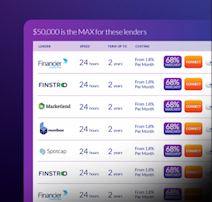

ebroker has all the leading non-bank business loan lenders in one place. Offering Unsecured business loans, Equipment Finance, Invoices Discounting and Trade Finance all delivered fast and easy.

70+ specialist business lenders in one simple site.

Fastest and easiest way to compare the lenders key differences.

ebroker is 100% independent so our results are unbiased.

No more wasted hours searching the net.

In the press

ebroker proudly Sponsor